ACADEMICS.web.id – Not everyone can pursue the highest levels of education. This was the case for my parents. Due to limited access, they could only complete elementary school (SD). After that, they focused on helping my grandparents with their work. Despite only finishing elementary school, they wished for their children to be able to pursue the highest possible education.

However, good intentions alone were not enough to provide us with the highest level of education. When I entered high school (SMA) in 2009, they had to pay the Educational Development Contribution (SPP) every semester. This meant that the higher our education level, the more expenses were required.

I still vividly remember the banknotes with images of Soekarno-Hatta that I had to submit every semester. My SPP payment at that time was Rp700,000. It might sound like a small amount, but it was significant for my parents, who worked as seasonal farmers. Not to mention the money for snacks and purchasing textbooks, something that always made my mother furrow her brow.

Fortunately, in 2011, the South Sulawesi government implemented free education from elementary to high school. Because they no longer had to pay SPP or buy textbooks, my parents began saving for my college education. I was grateful that upon graduation, I was accepted into a state university in Makassar. Meanwhile, my younger sibling was also able to continue their education in high school through the free education policy.

Among all the praises and accolades for the free education policy, there is an element that we often overlook — taxes. We are aware that the funds for school operations, building facilities, and providing books come from state funds. However, we frequently ignore that the largest contribution to these educational funds comes from taxes.

So how do taxes contribute to our education? Taxes are a mandatory contribution from a citizen or an entity to the state. Taxes are used for the country’s needs and the prosperity of the Indonesian people. Currently, taxes are the largest source of state revenue. The rest of the state’s revenue comes from grants and Non-Tax State Revenue (PNBP).

Data from the Directorate General of Taxes (DJP) indicates that tax revenue in 2023 was Rp1,869.23 trillion. This amount is equivalent to 108.8 percent of the 2023 State Budget (APBN) target or 102.8 percent of the target set in Presidential Regulation No. 75 of 2023.

Because tax revenue increased, the APBN also increased. This is evident from our spending target in the 2023 APBN, which was only Rp3,061 trillion. Meanwhile, the actual state expenditure reached Rp3,121.9 trillion, exceeding the 2023 APBN allocation target. Therefore, there is a correlation between the increase in tax revenue and the increase in APBN realization.

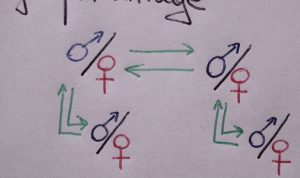

Similarly, the education fund aspect has also increased. If the APBN continues to rise, the education fund will also keep growing. This is reflected in the funds allocated for the education sector over the past three years. In 2022, it was Rp472.6 trillion, in 2023, Rp612.2 trillion, and the plan for 2024 is Rp660.8 trillion. This aligns with the increase in tax revenue. Tax revenue in 2022 was Rp1,171.8 trillion, in 2023 it was Rp1,869.2 trillion, and the target for 2024 is Rp1,986.9 trillion.

The above data clearly shows that the increase in the budget for the education sector in recent years is due to rising tax revenue and our increasing APBN realization. This is in accordance with the mandate of Law No. 20 of 2003. The law stipulates that the education budget must be at least 20% of the total APBN. The simple logic is that the greater the state’s revenue from taxes, the larger the APBN. The size of the APBN affects the 20% budget allocation for the education sector.

Another important point to note regarding the 20% education fund is that it is not solely for free education in schools. Instead, it covers all aspects of education, including education transfer funds to regions, the Ministry of Education, and the Ministry of Religious Affairs. Therefore, the education fund benefits not only our children who are in school but all elements of society involved in education.

In more technical policy terms, the education budget can be seen in programs at schools, universities, and in the community. These include funding for the Smart Indonesia Card (KIP) for college students, the Smart Indonesia Program (PIP), school renovations, and teacher allowances. The funds are also used for higher education operational support, and allowances for lecturers and professors, as well as research funds.

If students or lecturers with community service programs visit your village, that is also part of the “benefit of taxes” which is then implemented as educational funds. Similarly, when our parents in the village plant superior rice seeds, it might be the result of our agricultural students’ research utilizing state research funds.

In the end, our taxes have a tangible contribution to the advancement of our education. The tax money we pay to the state may today be school desks for children in Sabang, textbooks for our siblings in Papua, or salaries for teachers in Miangas and Rote Island.

Not to mention other sectors such as infrastructure, public services, and healthcare. All these are linked to our compliance with paying taxes. So, in the end, yes, our taxes are for us.@